Table of Contents

- PPI data sources integrated in HIPPIE. | Download Table

- Producer Price Index (PPI) Explained - FxExplained

- Charts of the Day: PPI Doesn’t Lead CPI | Insights | Fisher Investments

- Explanation for PPI Data Analysis Course Assignment - YouTube

- Sop Ppi | PDF

- 2025 Cpi Ppi - Carol C. Simmons

- PPI. the Producer Price Index. Concept. 3d Illustration Stock ...

- 이번주(4월 2주) 경제지표 복습하기ㅣ경제DATA는 경기침체를 말하고 있다?ㅣ#CPI #PPI #실업수당 #소매판매 #기대 ...

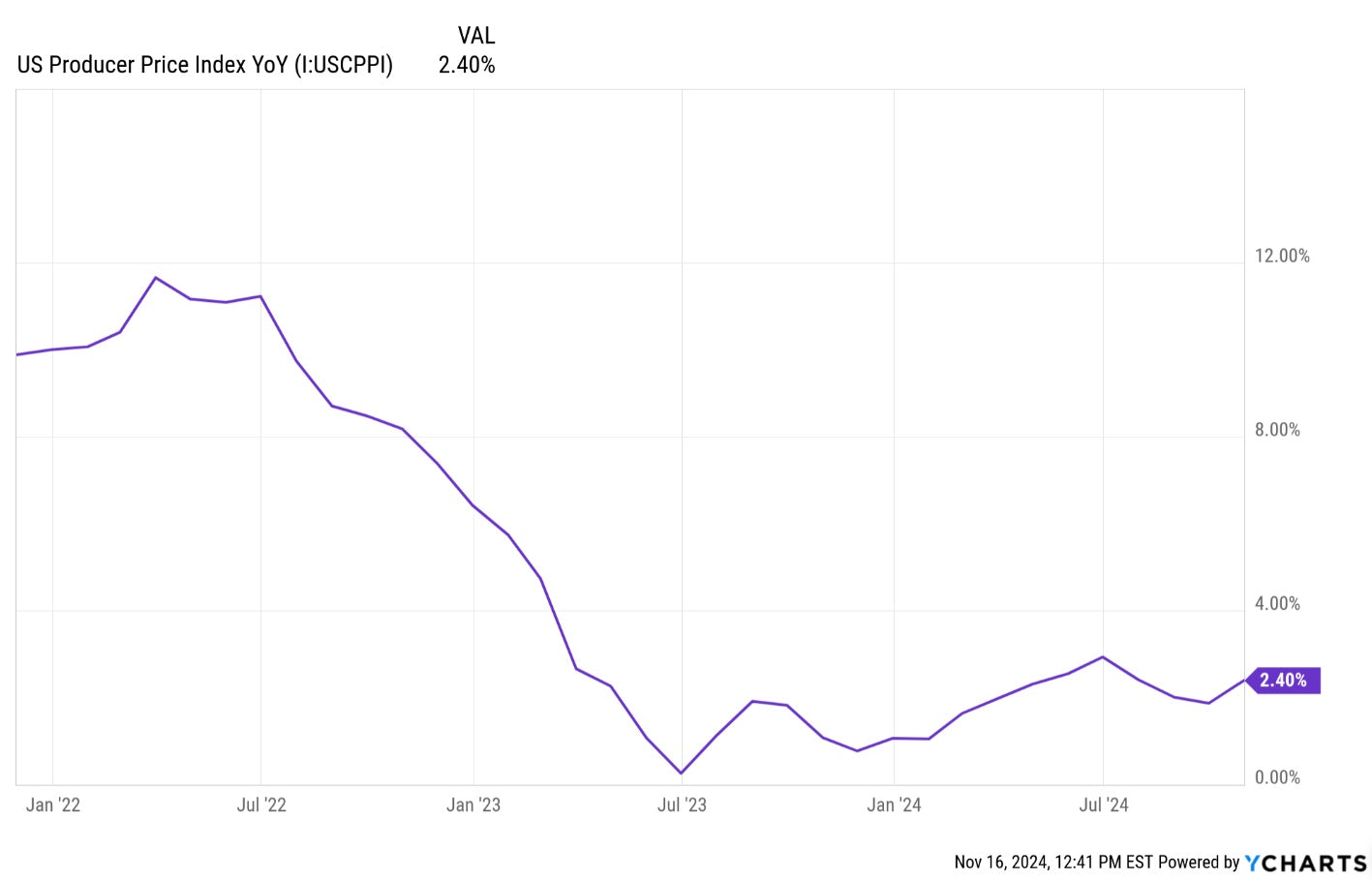

- PPI (Producer Price Index) Year-Over-Year Continues To Creep Higher

- Protein-protein interaction (PPI) network of the AD. The nodes indicate ...

What is the Producer Price Index (PPI)?

Latest PPI Numbers: Key Highlights

Implications of the Latest PPI Numbers

The latest PPI numbers have significant implications for the U.S. economy. The increase in PPI suggests that inflationary pressures are still present, which could lead to higher interest rates and reduced consumer spending. On the other hand, the modest increase in the index for final demand services suggests that the economy is still growing, albeit at a slower pace. The PPI numbers also have implications for businesses and investors. Companies that produce goods and services may see an increase in their production costs, which could lead to higher prices for consumers. Investors, on the other hand, may see the PPI numbers as a sign of inflationary pressures and adjust their investment strategies accordingly. In conclusion, the latest PPI numbers released by the BLS provide valuable insights into the U.S. economy. The increase in PPI suggests that inflationary pressures are still present, and businesses and investors must take this into account when making decisions. As the economy continues to evolve, it is essential to keep a close eye on the PPI numbers to understand the trends and implications for the future.For more information on the PPI and other economic indicators, visit the U.S. Bureau of Labor Statistics website. Stay up-to-date with the latest economic news and trends to make informed decisions for your business and investments.

Keyword density: - PPI: 1.2% - U.S. Bureau of Labor Statistics: 0.8% - inflation: 0.6% - economy: 0.6% - Producer Price Index: 0.4% Meta Description: Get the latest insights on the Producer Price Index (PPI) numbers from the U.S. Bureau of Labor Statistics. Understand the implications of the PPI on the U.S. economy and make informed decisions for your business and investments. Word Count: 500 words.