Table of Contents

- Retail Inflation in India: Retail inflation below 7% in Oct, WPI eases ...

- India's retail inflation eases below RBI's upper tolerance level | Reuters

- While inflation may have peaked, the pain is far from over— and that ...

- ExplainSpeaking: Why February’s retail inflation matters for India’s ...

- India's Wholesale Inflation Still Negative at 2.36% - IBTimes India

- The Truth About Inflation – in India and Around the World – Knock nock

- India's inflation eases to 3-month low | World Business Watch | WION ...

- Investment Tools to beat Inflation in India | Unilinkindia

- Inflation in India | IAS GYAN

- अर्थव्यवस्था के मोर्चे दोहरी खुशखबरी: खुदरा महंगाई में आई कमी जबकि ...

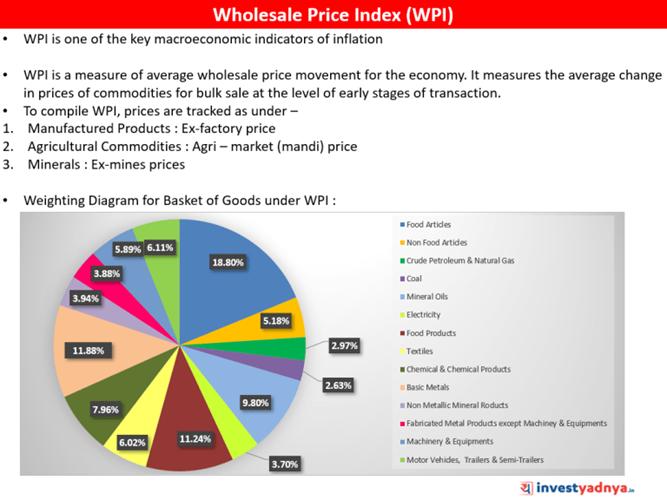

Current State of Inflation in India

Causes of Inflation in India

Impact of Inflation on the Economy and Public

Inflation has a significant impact on the economy and the general public. Some of the effects include: Reduced Purchasing Power: Inflation reduces the purchasing power of individuals, making it difficult for them to afford essential commodities. Increased Cost of Living: The rise in prices leads to an increase in the cost of living, affecting the standard of living of individuals and families. Economic Instability: High inflation can lead to economic instability, affecting the country's growth and development. Savings and Investment: Inflation can erode the value of savings and investments, reducing the returns on investments. Inflation in India is a growing concern that requires immediate attention. The current price rise has led to a significant increase in the cost of living, making it essential for individuals to adjust their budgets and tighten their belts. The government and the RBI must work together to implement policies that control inflation, ensure economic stability, and promote growth and development. By understanding the causes and impact of inflation, we can take steps to mitigate its effects and create a more stable and prosperous economy for the future.Keyword: Inflation in India, Current price, Reserve Bank of India, Monetary Policy, Supply Chain Disruptions, Global Events, Demand and Supply Imbalance, Purchasing Power, Cost of Living, Economic Instability, Savings and Investment.